The Missing Link

9/6/2019

Aligning the Lean Transformation by Connecting Operational Improvement with Financial Outcomes

by Mark R. Hamel, J.W. Ballard, and Andrew Bargerstock

Here’s a simple, seemingly innocuous question for lean leaders, “What financial benefits have accrued as a direct result of the (fill-in-the-blank) lean transformation effort?”

Gulp. Simple does not mean easy.

The question is often met with a brief uncomfortable silence belying the realization that leadership has not quite characterized improvements in financial terms. This is followed by a litany of operational improvements and anecdotal evidence of wonderful things, shared partly to validate the truly excellent work and partly to draw attention away from the missing financial link.

Why does a question that should not be unanticipated catch many lean leaders flat-footed? It’s perplexing and unnecessary.

Effective lean transformations coincide with favorable cultural change, driving meaningful and sustainable operational and financial performance improvement. Yet, while improved financial outcomes may be the single or a top reason for a lean launch (a.k.a. business problem to be solved) the linkage between improvement activities and financial performance are often unknown, ambiguous, and/or ignored. This inhibits financial performance gaps from “pulling” the most effective lean deployment strategy, muddies leadership’s understanding of causality and unfortunately prevents leaders from “seeing” the lean financial impact. Good activity-to-financial line-of-sight facilitates engagement, buy-in, and proper mindset. How do we find or create the missing linkages between operational improvement and financial outcomes?

An “Average” Lean Launch

It may be helpful to quickly reflect on an “average” lean launch to (very imperfectly) characterize the background and gain some insight into why lean leaders often miss the financial link. Lean launches start predominately in “operations,” no matter the industry. Operations leaders often interface with Finance and Accounting (F&A) ineffectively. Sometimes this is because F&A does not engage and/or are left behind as the impatient move forward. Furthermore, the lean transformation launch decision is often regrettably not made at or near the very top of the organization, this while the initial activities are targeted and, in some ways “air dropped” still lower in the organization. Here, people are not trained or accustomed to considering the linkage between activity and financial outcomes, nor given measures with which to do so. At this stratum, the promises of activity-based costing, value stream costing/profitability, and “plain English financial statements” are unknown and unrealized.

If we are to take the guidance reflected in the seminal lean book, Lean Thinking, we know that we are to forget grand strategy and start lean by identifying/targeting a product family, value stream map both the current and future states of that family, and then achieve the future state by executing the projects, kaizen events, and just-do-its reflected in the value stream improvement plan. Easy peasy.

But wait, the coin of the realm in value stream analysis is inventory by which Little’s Law mathematically derives queue time. The summation of queue and processing time is lead time. Then there is process yield and rolled throughput yield. With a little more math, we can get at work content, productivity, overtime, scrap, and a few other things. Clearly, there are a handful of financial drivers here, but they are often almost accidental benefits rather than purposeful, targeted opportunities. It does not take too much imagination to see how we could measurably improve the operational performance, but then still have that awkward moment described above when someone asks the financial impact question. In other words, absent effective leadership alignment, value stream analysis is a blunt financial measurement tool.

Now, we are not dismissing the deep lean faith that consummate senior lean leaders have who operate within a management-by-means model and know (!) that great processes will drive great results, both operationally and financially. But maybe we have some of our thinking backwards.

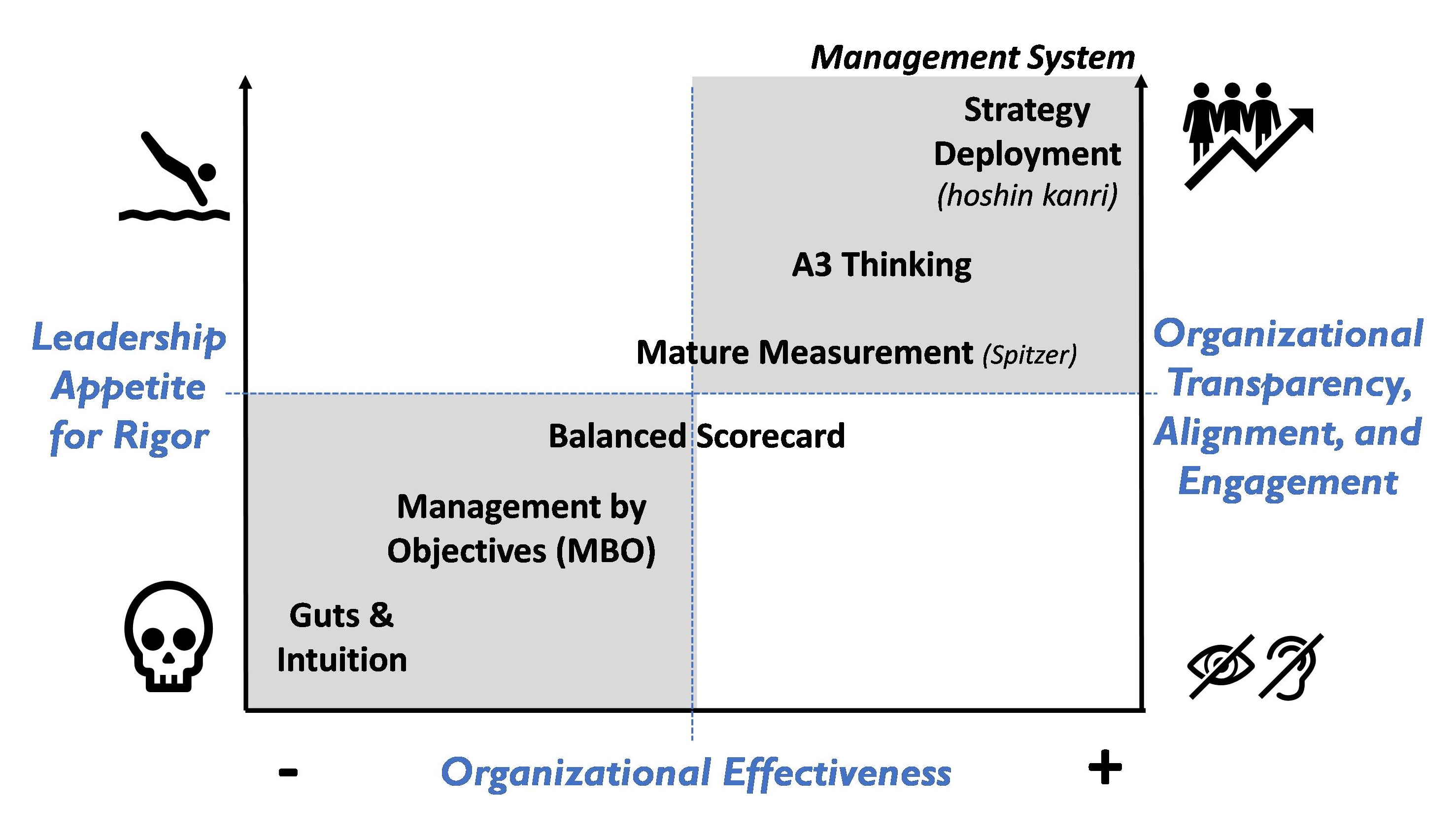

Figure 1. Measurement and linkage maturity.

Figure 1. Measurement and linkage maturity.

Perhaps we should, to modify a Taiichi Ohno quote, start from financial need. Clearly, from a mature lean perspective, we desire to start from True North and the organization’s resultant broad-brush goals (hoshins), then engage in strategy deployment which encompasses, among other things, the financial imperatives.

This kaizen cycle is sustained by a complete management system that is founded on measurement and linkage maturity, Figure 1. In fact, effective measurements and reports on linkages between activity and operating cash for the entire value creation system provide organizations with insight into the existence and magnitude of performance and process control gaps, help reveal causality, and facilitate collaborative gap-closing strategies and tactics. Organizations that reside in the upper right quadrant of Figure 1, enjoy a management system that is aided by A3 thinking and incorporates strategy deployment for breakthrough performance improvement. They also enjoy mature visual measurement systems for daily improvement, effective vertical and horizontal alignment, line-of-sight on activity-to-results, and engage people at all levels.

Yet, not all organizations have the lean management system maturity, appetite, stamina, and/or rigor yet to negotiate that approach. Is there a middle way which assures the financial linkage?

What if we provide a relatively simple illustration which employs an expansion of the fictional Acme Steering Bracket family example reflected in the seminal value stream mapping book, Learning to See, by Mike Rother and John Shook? Perhaps we can use the example for learning to see the “missing link.”

Acme Steering Brackets Revisited

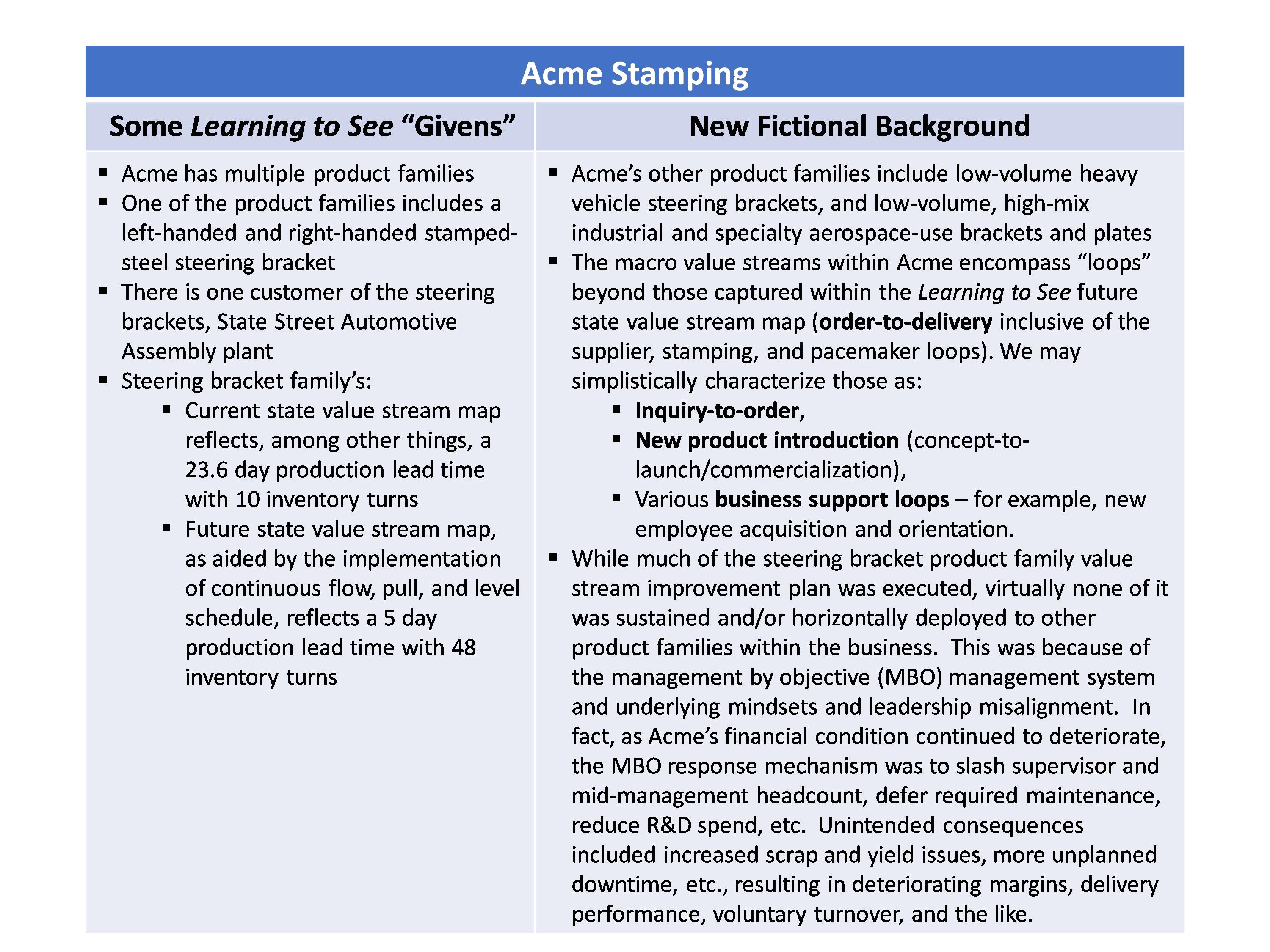

First, let us establish what Learning to See has shared about Acme and then add some “new” information to generate a broader business picture (see Table 1). In other words, let’s make a more comprehensive, but still rather uncomplicated case to illustrate a way in which we can make the linkage between the transformation and its desired financial outcomes more manifest and actionable.

In a traditional lean transformation, the picture reflected in Figure 2 will be supplemented with operationally and financially-oriented key performance indicators. Depending on the sophistication of the organization, other insights will also be incorporated to provide a better picture of the current condition and to characterize the business problem to be solved.

Table 1. Acme – an expanded case. The left column reflects insights directly gleaned from the book, Learning to See. The right column reflects new, fictional background information to help build out the case within this white paper.

As referenced in Table 1, Acme lives in the very populated “MBO” region within Figure 1. MBO organizations are often characterized by a fixation on a handful of basic metrics, mostly financial, with a smattering of operational ones. As you may guess, the predominate focus is on “hitting the numbers,” with little regard for the efficacy, robustness, and scalability of the underlying processes or value streams. This type of by-whatever-means-necessary drives mindsets and thus behavior and ultimately long-term performance that is antithetical to lean. So, where do we start?

Given that leadership alignment is essential for an effective lean transformation and should be initiated from the very top, what if we were to engage just the CEO, COO, and CFO in a type of pre-work and discovery? What could that look like?

CEO, COO, and CFO Engagement

Here we can facilitate a low-intensity discussion with the CEO, COO, and CFO to help them characterize the current condition. With a little bit of coaching, we can get to a high-level, lean game plan to achieve improved financial performance. An iterative approach will employ the following.

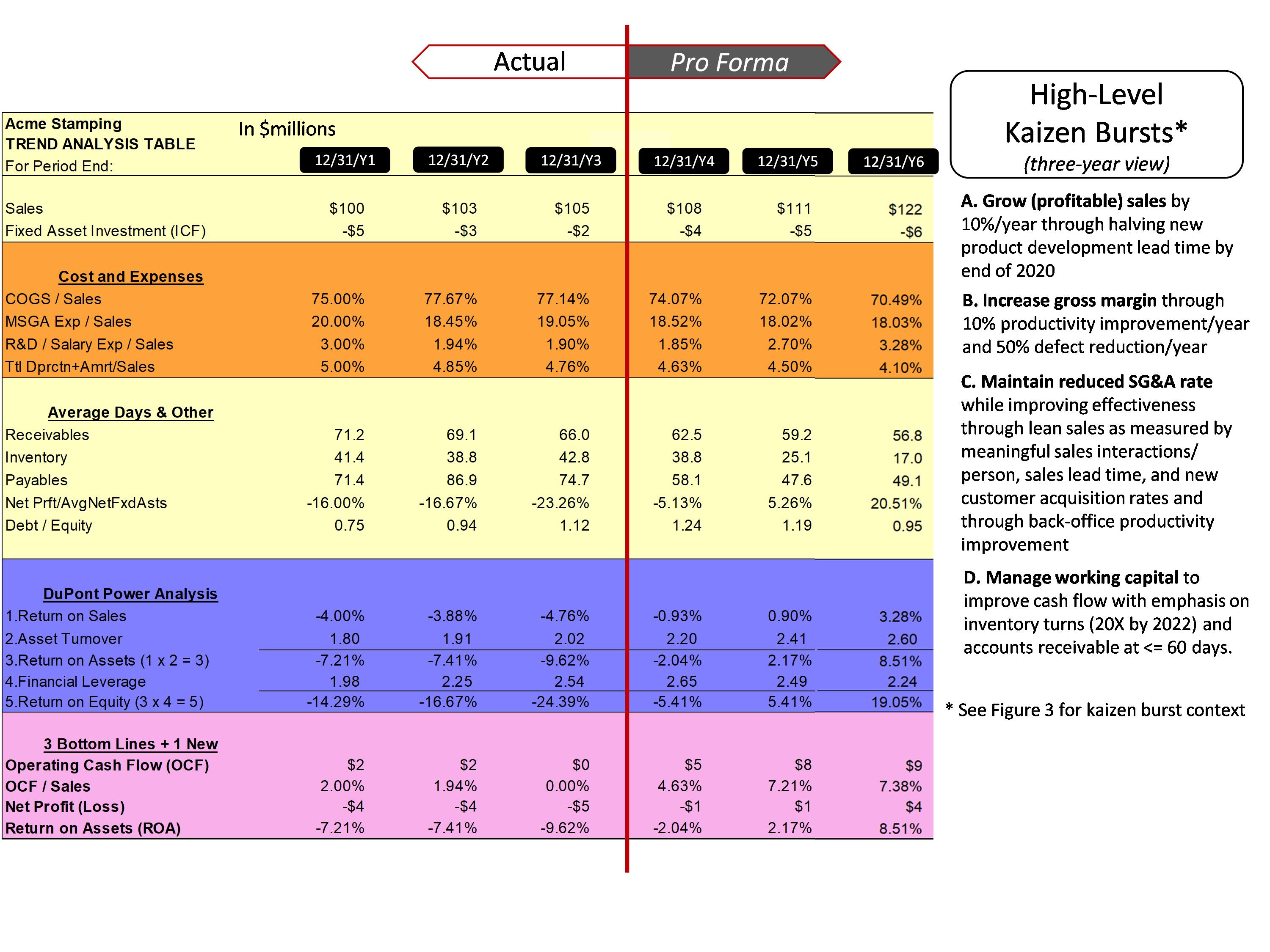

1. Financial analysis. We start by populating a relatively simple spreadsheet template that will trend financial performance as defined by the measures and analytics reflected in the right half of Figure 2. The template outputs will facilitate the identification of quantified key gaps and then the generation of pro forma (a.k.a. projected) financial performance reflective of necessary improvements. For example, operating cash flow must improve by $2 million in the next year. This can theoretically be effected through a combination of 2% margin enhancement and improved inventory turns (10X to 15X), and accounts receivable days sales outstanding (80 DSO to 72 DSO). See Figure 4 for an Acme Stamping example.

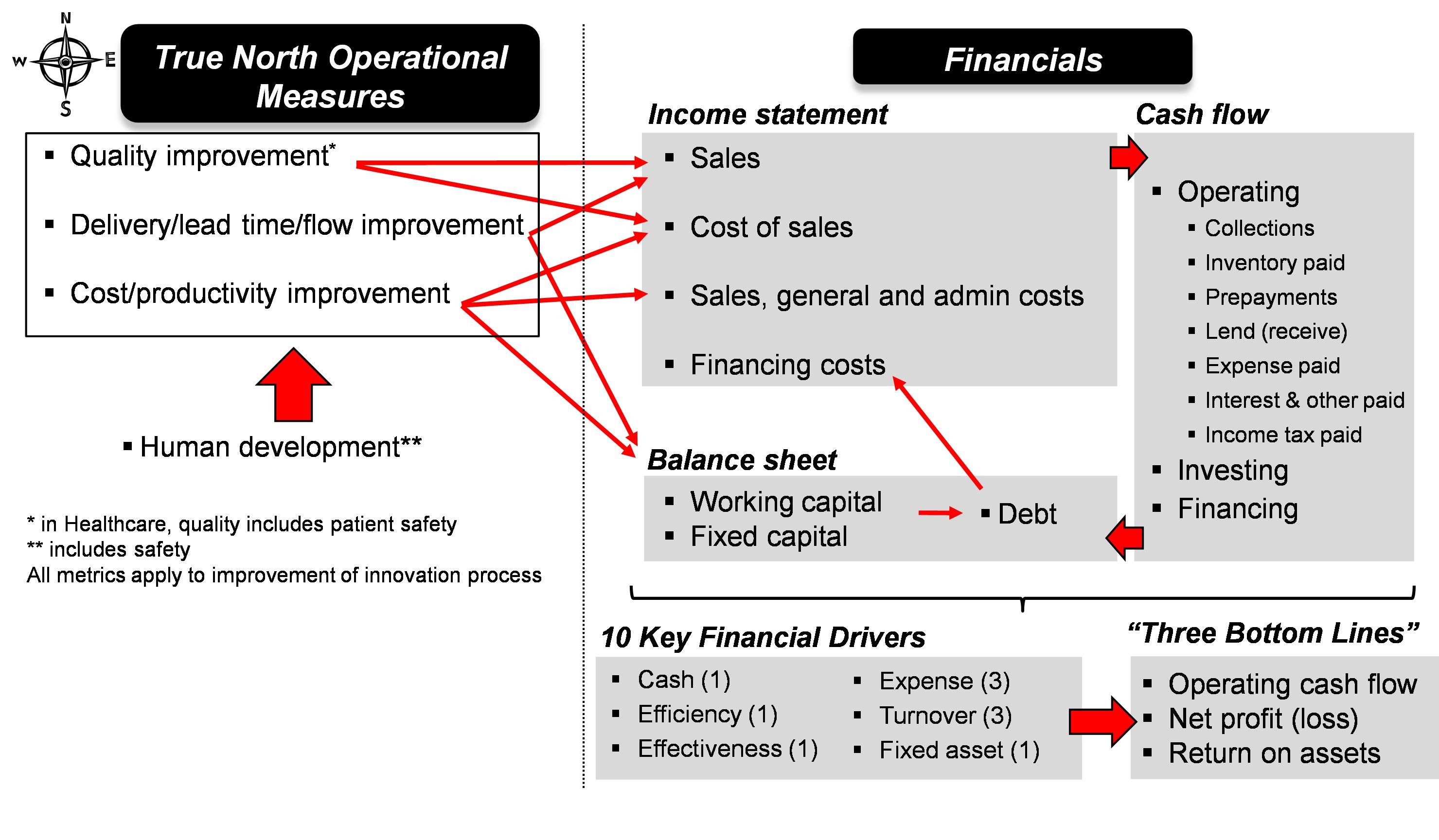

Figure 2. Operational - Financial linkages. Traditional True North-oriented lean measures or metrics drive financial performance that should be manifest within the cash flow statement, income statement, and balance sheet of the subject company, business unit, and/or value stream. 10 key financial drivers and the “Three Bottom Lines” can be readily gleaned from the financial statements and provide insight into gaps, trends, and opportunities for improvement. See Figure 4 for an example of the financial drivers and three bottom lines.

Figure 2. Operational - Financial linkages. Traditional True North-oriented lean measures or metrics drive financial performance that should be manifest within the cash flow statement, income statement, and balance sheet of the subject company, business unit, and/or value stream. 10 key financial drivers and the “Three Bottom Lines” can be readily gleaned from the financial statements and provide insight into gaps, trends, and opportunities for improvement. See Figure 4 for an example of the financial drivers and three bottom lines.

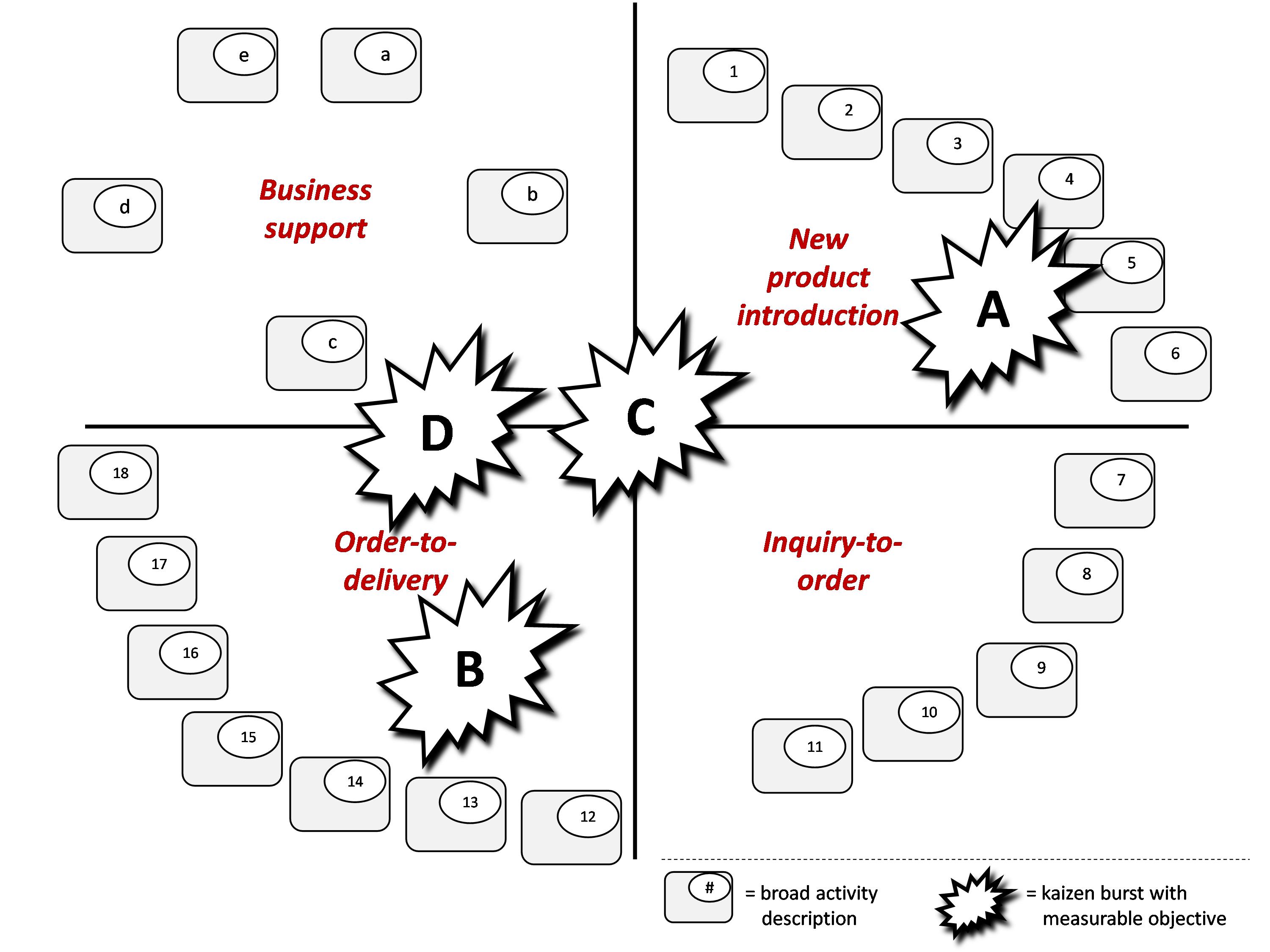

2. Macro enterprise analysis. The next activity begins with mapping the business’ extremely high-level wing-to-wing current state enterprise (Figure 3) along with reviewing the trending operational metrics that are (hopefully) in family with the left half of Figure 2. Here we may identify a gap in the scope and/or sufficiency of the operating measures, for example, quality measures may be limited to customer complaints and “escapes,” all very important, but they do not characterize internal quality performance that ultimately drives customer-felt quality, rework, scrap, etc. Next the CEO, COO, and CFO will identify the critical few major issues or disconnects within that macro enterprise map that are unfavorably driving operational and financial performance. For these issues they will generate high-level kaizen bursts that reflect the “what” with very high level “how” (not the detailed “how”) in terms of a related “master measure” which will drive the desired behaviors that link to financial performance. The horizon for these bursts is typically in the two to three-year horizon (not unlike strategy deployment breakthrough objectives). An example burst could be reduce new product time to market lead time by 50% by December 31, 20Y3. The total quantity of distinct master measures and kaizen burst should be in the three to five range, again like the focus on the critical few that is employed in effective strategy deployment.

Figure 3. Macro-level enterprise map with kaizen bursts. This is a representative presentation of a four-quadrant map showing the sequential major activities of the three primary value stream loops (new production introduction, inquiry-to-order, and order-to-delivery) with one quadrant reflecting the major business support activities (i.e., IT, HR). The kaizen bursts reflect targeted improvement opportunities corresponding to the map area. See Figure 4 for the detail associated with each burst.

3. Pro forma financials validation. Next we revisit the pro forma financials (cash flow statement, balance sheet, income statement) across future periods, inserting the anticipated improvements derived from the enterprise map kaizen bursts, their master measures and related goals. It is important to understand the impact on the 10 key financial drivers and the three bottom lines, reflected in Figure 4. The process employs a cycle: 1) plan the quantified improvement, 2) insert or capture the quantified improvement within the pro forma, 3) check to see if the overall financial implications are as expected/required, and finally 4) adjust the plan (or expectations) as appropriate. Clearly, this is simply “paper kaizen” and the CEO, COO, and CFO are not engaged in implementation, but the exercise draws them into the direct hands-on use of an easy financial model. This same type of activity will also empower the next-level leadership to build on/develop their “own” forecast, freeing them from the insular effect of financial experts and intermediaries.

Figure 4. Actual and pro forma financials and related three-year kaizen bursts. This trend analysis table was quickly generated by inputting historical and pro forma values into corresponding balance sheets and income statements to reveal both their related direct and indirect cash statements. The pro forma inputs were generated by applying the anticipated impacts reflected in the kaizen bursts to prior period(s)’ performance.

Figure 4. Actual and pro forma financials and related three-year kaizen bursts. This trend analysis table was quickly generated by inputting historical and pro forma values into corresponding balance sheets and income statements to reveal both their related direct and indirect cash statements. The pro forma inputs were generated by applying the anticipated impacts reflected in the kaizen bursts to prior period(s)’ performance.

Next Steps for Acme

Now that the CEO, COO, and CFO share the same, albeit imperfect, understanding of the current condition, and have characterized the missing link(s) between operational levers and financial results, along with a high-level game plan, we have a foundation for further catchball and the all-critical leadership alignment. What is the leadership alignment purpose and process?

At a very summary level, the purpose is to ensure that senior leadership shares and/or supports a common understanding of:

- the current condition,

- the business problem(s) to be solved through lean,

- the mindsets and cultural challenges that must be managed and coached to achieve the leadership-defined target condition,

- the scope, approach and measurable targets for a lean pilot and associated projects that will drive the associated business impact and organizational learning, and

- the necessary internal infrastructure and resource commitments

The process entails a pre-leadership alignment session preparatory phase during which the following is conducted:

- a brief leadership alignment orientation session for all senior leaders,

- senior leadership interviews,

- interviews of a subset of the folks within the organization,

- cultural survey of the broader organization,

- business condition review,

- direct observations at the gemba,

- etc.

This data is synthesized and incorporated in a facilitated (typically two-day offsite) alignment session with the senior leadership team. Just prior to this session, a multi-day detailed enterprise mapping session is conducted with the leadership team to document and grasp the business’ value proposition, voice of the customer, and effectiveness of the company’s products and services to address customer needs within the context of the current state enterprise map. During the session, the team formulates strategies and related measurements to address the most critical gaps. These are the analog to what the CEO, COO, and CFO identified in their preliminary sessions and will require convergence or reconciliation, real-time, with the combined CEO, COO, and CFO’s outputs, inclusive of the financial analysis.

Ultimately, the lean transformation launch will be governed by senior leaders, employing their defined leader standard work, which, among other things, necessitates them to check and coach around the existence of the transformation plan, the adherence to that plan, and the sufficiency of the plan to achieve the desired outcomes. All must include and reflect the operational and financial linkage so explicitly drafted and established with the CEO, COO, CFO, and senior leaders, then cascaded throughout the deployment process.

Next Steps for Your Organization

So how do the things illustrated in the updated Acme model apply to your organization and its lean transformation? Perhaps the best way to start (and end) is with reflection:

- How would you characterize your organization’s measurement and linkage maturity?

- Have you had or do you anticipate that embarrassing question around the lean launch financial impact? How did or will you answer it?

- How well do you think leadership and other key stakeholders understand the linkage between their lean activities and the financial health and well-being of the organization?

- How much more effective do you think your lean transformation efforts can be with the proper and purposeful linkage between operational improvement and financial outcomes?

- What are your next steps?

About the Authors

Mark R. Hamel. Mark ispartner and COO at The Murli Group, a two-time Shingo award-winning author, speaker, and Lean Enterprise Institute (LEI) faculty member. In his 19-year pre-consulting career, he held executive and senior positions within operations, strategic planning, business development, and finance. Mark’s lean education and experience began in the early 1990s when he conceptualized and helped launch what resulted in a Shingo-Prize-winning effort at the Ensign-Bickford Company. He is a CPA in the state of Connecticut and is dual APICS certified in production and inventory management (CPIM) and integrated resource management (CIRM). Mark was a national Shingo Prize examiner for eight years, has helped develop exam questions for the AME/SME/Shingo Lean Certification, and is Juran certified as a Six Sigma Black Belt. He authored the Kaizen Event Fieldbook: Foundation, Framework, and Standard Work for Effective Events and co-authored Lean Math: Figuring to Improve. Both SME-published books won a Shingo Professional Publication Award, in 2010 and 2017, respectively.

J.W. (Jahn) Ballard. Jahn is a CashCommand™ and Executive Finance Coach who has been teaching mature measurement of cash and value creation as a core leadership skill for decades. He has invented and facilitated Management Operating System upgrades for dozens of community and commercial enterprises, and co-developed the Financial Scoreboard®. Seven upgrade use cases are available. Jahn has delivered the Executive Finance for Operating Leaders workshop to a 1,000 CFOs, controllers and CPAs for Accounting & Auditing Continuing Professional Education. His mission is bringing spirit to money and joy to work by co-create enterprising environments in which everyone, including himself, can give their gifts. He is the co-author of Mastering Leadership Alignment: Linking Value Creation to Cash Flow, Business Expert Press, 2107 and master licensor for Financial Scoreboard and Managing by the Numbers, Inc., 2000.

Andrew Bargerstock, M.B.A., C.P.A., Ph.D. Andrew Bargerstock, M.B.A., C.P.A., Ph.D., is President of Vanguard Resource Group, Inc., an Iowa business consulting firm. He has consulted with federal and state governmental agencies, large corporations. As a Divisional VP, Bargerstock guided the sales turnaround of a subsidiary division of Readers Digest in the early 2000s. In recent years, he has become an investment educator for Rule 1 Investing, an Atlanta-based investment services firm. He is a published author in peer-reviewed journals in accounting and finance and co-author of the book Mastering Leadership Alignment: Linking Value Creation to Cash Flow (2017). Bargerstock has been recognized several times with national and global awards in management and lean accounting including the IMA’s Lybrand Gold Medal Award (2017) for the article “Leaning Away from Standard Costing” as the best contribution to advancing thought in the field of management accounting. In 2009 and 2016 he was recognized as the Lean Accounting Professor of the Year by the Lean Enterprise Institute and the Lean Accounting Summit.

Comments:

This post is more than 730 days old, further comments have been disabled.

Contact The Murli Group

Find out how we can help strengthen your company from the ground up»